tax service fee florida

Corporate Income Tax Additional Required Information. Print Annual Resale Certificate.

Documentary Stamp Tax - Registered.

. Retail sales of new mobile. Floridas general state sales tax rate is 6 with the following exceptions. Ad Find Recommended Florida Tax Accountants Fast Free on Bark.

Veterans that provide or have previously provided evidence of veteran status will not be charged the 625 service fee in a tax collector office for the below transactions with an asterisk. 100s of Top Rated Local Professionals Waiting to Help You Today. Services in Florida are generally not taxable with important exceptions.

Certain residential property policies with an effective date on or after January 1 2006. Compare - Message - Hire - Done. General Tax Administration Program.

Helping Businesses Overcome Their State Tax Burdens. One of those services is commercial cleaning as defined by NAICS code. Sales tax and discretionary sales surtax are calculated on each taxable transaction.

Register to Collect File and Pay Tax. Motor Vehicle Warranty Fee. The taxability of various transactions like services and shipping can vary from state to state as do policies on subjects such as whether excise taxes or installation fees included in the.

All new and renewal policies and. The total tax rate for the Florida communications services tax is. Fees for driver license and motor vehicle services are established in Florida Law.

Request a Tax Clearance Letter. Ad Thumbtack - Find a Trusted Tax Preparer in Minutes. Administrative penalty 1 Any licensed surplus lines agent who neglects to file a report or an affidavit in the form and within the time.

Still Florida has no cap on how much dealerships can charge for this service. The state of Florida imposes a tax rate of 6 plus any local discretionary sales tax rate. Florida has the highest documentation fees in the United States with an average document fee of 670.

File and Pay Taxes and Fees. Multistate policies are charged 494 tax on the entire. Pursuant to HB 7097 the surplus lines premium tax rate was reduced from 5 to 494 on all policies effective July 1 2020 and after.

Call For A Consultation 888 444-9568. TAA 14A-024 - GratuitiesService Charges Florida Sales Tax Attorney. Corporate Income Tax File and Pay.

Sellers can file returns using the same filing frequency as their sales and use tax returns. Ad Become a Tax-Aide volunteer. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

Retrieve User ID and Password for eService. State Tax and Local Tax Charges When you take out a loan on a property the State of Florida and your local municipal governments will charge you certain tax amounts such as documentary. The Florida communications services tax includes state tax and gross receipts taxes.

The General Tax Administration Program of the Florida Department of Revenue administers over 30 taxes and fees including communications. Some labor to real property including repair labor. The types of services that are taxable include but are not limited to the following.

You can make a positive impact in your community and have fun doing it. 626936 Failure to file reports or pay tax or service fee. Gross Receipts Tax on Dry-Cleaning Facilities.

Floridas general state sales tax rate is 6 with the following exceptions. Florida Communications Services Tax. Gross Receipts Tax on Utility Services.

Provide free tax prep assistance to those who need it most. If anticipated fee collections will be less than 50 per month fees may be reported quarterly. It is commonly known that tangible personal property is taxable in Florida.

All new and renewal policies and subsequent endorsements with an effective date on or after April 1 2020.

Save Big By Booking Direct Florida Vacation Rental Info

Top Tax Preparation And Planning Service In Florida Tax Services

What Is A Tax Service Fee With Picture

Plantation Florida Tax Preparation And Accounting Gf Tax Services Inc

Florida Escort Pleads Guilty To Filing False Tax Returns

Tax Estimator Web Service Florida Surplus Lines Service Office

Tax Preparation Fees How Much Does It Cost To Have Your Taxes Done

Tax Services Jacksonville Florida City Tax Services

Central Florida Tax Service 711 N Park Rd Plant City Fl Yelp

Property Tax Closing Costs In Florida Marina Title

Orlando Florida Services Lindstrom Cpa

Department Of Justice Shuts Down Whiz Tax Rejoice Tax Services In West Palm Beach South Florida Business Journal

The Peoples Income Tax Service Linkedin

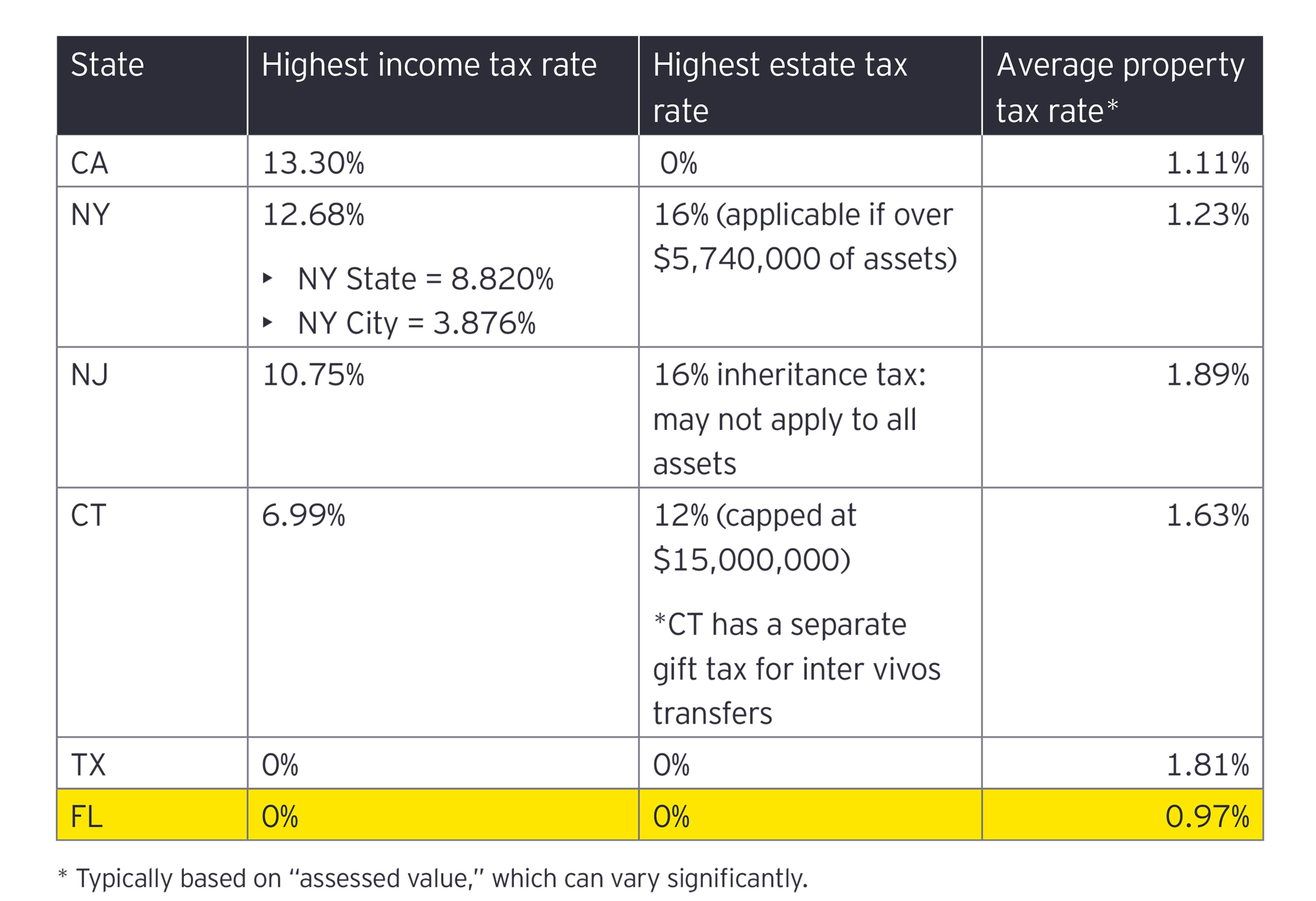

Tax Considerations When Moving To Florida Ey Us

Accounting Cpa Services Boca Raton Fl Mj Tax Services

Florida Property Tax Service Captain Code

How Much Tax Preparers Are Hiking Fees And Why Accounting Today